As DeepSeek’s next-generation artificial intelligence model nears its rumored launch date, the tech world is holding its collective breath. DeepSeek V4, anticipated to be unveiled during...

The rivalry between the United States and China in the field of artificial intelligence (AI) and large language models (LLMs) has never been more intense. In...

In a stark warning to U.S. policymakers, NVIDIA CEO Jensen Huang says the real threat to American dominance in artificial intelligence isn’t China’s ambition—it’s America’s own...

In January 2025, a little-known Chinese AI startup quietly flipped an entire industry’s script. DeepSeek, with a breakthrough model built for just a few million dollars,...

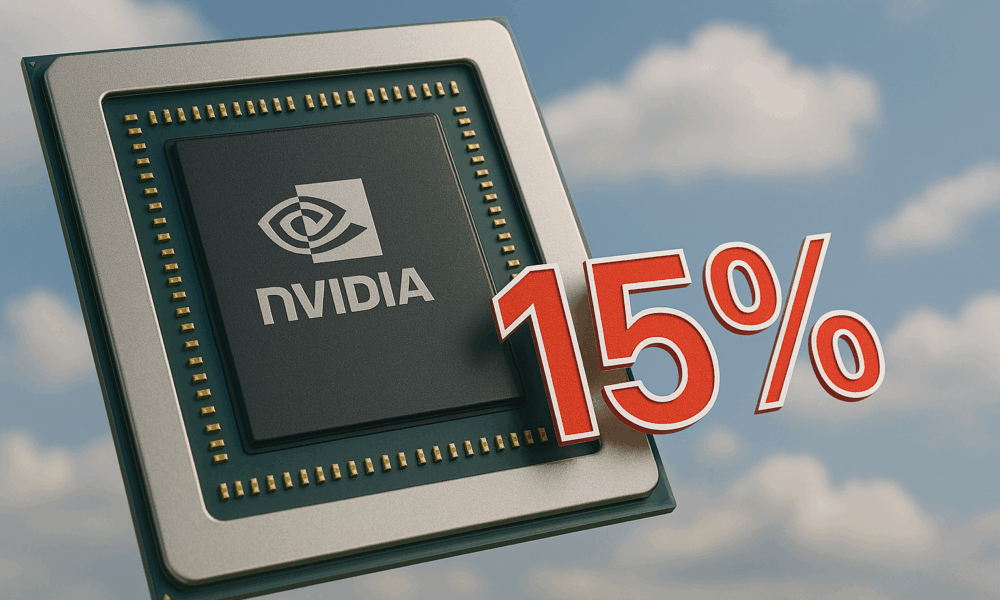

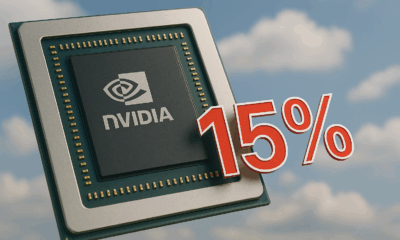

A New Kind of Tech Deal In a move that has stunned both Wall Street and Washington, the United States government has secured a 15 percent...