In a landmark announcement, NVIDIA has introduced an open-source AI system that could radically accelerate the future of autonomous driving. The centerpiece is DRIVE Alpamayo-R1 —...

In a move that could reshape the AI and autonomous vehicle landscape, Tesla has signed a staggering $16.5 billion contract with Samsung to manufacture its next‑generation AI6...

As artificial intelligence reshapes the global economy, two giants—NVIDIA and Tesla—have emerged at the forefront of a revolutionary idea: every modern machine company must operate with...

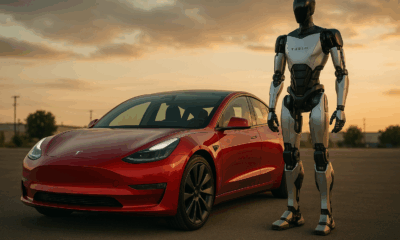

A Surprising Setback In a Long‑Promised Promise Tesla has hit a snag in its journey toward making Optimus — its humanoid robot — a mass‑market reality....